by Igor Kononenko, Anton Repin

THE REGULARITY OF THE COUNTRY’S GDP GROWTH RATE CHANGES INFLUENCE ON THE VOLUME OF GROSS FIXED CAPITAL FORMATION

The regularity of a country’s GDP growth rate changes affecting capital investment volume into its economy for countries with a different economic state was proposed. One of the features of this regularity is as follows: there is an obvious increase of capital investment providing that GDP growth rate exceeds a certain threshold. Moreover, this increase occurs at any changes of the GDP growth rate of the above-threshold region. For the first time, this regularity was discovered in 2005 for the European transition economy countries.

The regularity of the country’s GDP growth rate changes influence on the volume of GFCF.

Prior to the proposed regularity description, it is necessary to define the so-called “threshold”, which is often referred to hereinafter. Having analyzed the economic processes in the countries mentioned above in terms of the dependence of GFCF from GDP growth rate we came to the conclusion that it is possible to identify a threshold of GDP growth rate for each economy with high accuracy. It is important that if GDP growth rate for some year is higher than the threshold value, the change in investment for the same year is described by a certain algorithm, and if it is below the threshold a different algorithm can be used.

For more details, we will show it with the direct description of the regularity.

There is a well-known notion of a “zero” threshold in the economy. If GDP growth rate is above zero the economy “works” with a plus if lower –with a minus. We discovered that another threshold value other than zero is always positive, which is defined for the economy of every country of the described range.

Thus, the threshold value is the value of GDP growth rate, above and below which the investment in the economy is subject to different rules.

Proceed directly to the regularity, the essence of which is as follows.

- First, there is the growth of capital investment in the economy if the GDP growth rate is above a certain threshold value which is different for each country. Moreover, investment growth is observed with increase and decrease of GDP growth rate, provided GDP growth changes occur in the above-threshold area..

- Secondly, there is a decrease, or (rarely) stabilization of the volumes of capital investment into the economy in case a GDP growth rate falls if the reduction of GDP growth rate is observed in the area below the threshold.

- Thirdly, there is a rise in investment or stabilization with an increasing GDP growth, if such an increase occurs in the area with positive values.

- Fourthly, if the increase of GDP growth occurs in the area of negative growth values, this process is accompanied by an investment decrease.

- In the fifth place, if a GDP growth is in the area of positive values of growth after a period of GDP growth falling in the sub-threshold zone there is an investment reduction (which in rare cases may happen even a year after such a fall).

The points at which GDP growth rate corresponds exactly to the value of the threshold behave either as sub-threshold or as above-threshold.

The established regularity is to define the dependence of the volume of capital investment in the economy and GDP growth rate for the same year and with one year delay of capital investment indicator. In the latter case, the dependence of the investment volume in the year t and GDP growth rate in the previous year is considered.

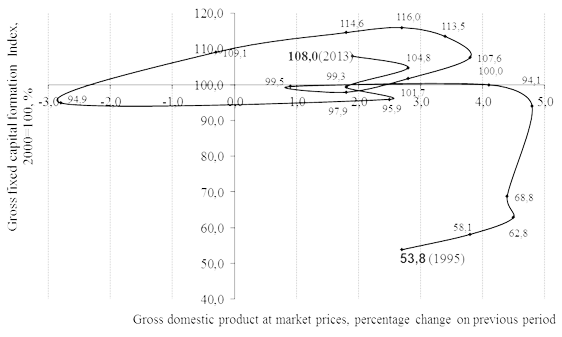

Fig. 1 shows a graphical interpretation of the established regularity in general.

Verification and illustration of the regularity on the example of economies around the world. The testing results of the regularities on the statistical data defining the economic processes in 33 European countries, as well as the United States and Japan are demonstrated in Tables 1 and 2.

Table 1 – The results of the regularity verification for the analyzed economies

| Number | Country | Research period / number of analyzed points | Number of points satisfying the regularity | Number of points not satisfying the regularity | Regularity satisfying, percentage of total number of points |

| 1 | Austria | 1995-2012 / 17 | 15 | 2 | 88,94 |

| 2 | Belguium | 1996-2013 / 17 | 16 | 1 | 94,12 |

| 3 | Bulgaria | 1996-2013 / 17 | 15 | 2 | 88,24 |

| 4 | Croatia | 1996-2013 / 17 | 17 | 0 | 100 |

| 5 | Czech rep. | 1995-2013 / 18 | 18 | 0 | 100 |

| 6 | Cyprus | 1996-2013 / 17 | 15 | 2 | 88,24 |

| 7 | Denmark | 1995-2013 / 18 | 15 | 3 | 83,33 |

| 8 | Estonia | 1995-2013 / 18 | 18 | 0 | 100 |

| 9 | Finland | 1995-2013 / 18 | 18 | 0 | 100 |

| 10 | France | 1995-2013 / 18 | 17 | 1 | 94,44 |

| 11 | Germany | 1995-2013 / 18 | 16 | 2 | 88,89 |

| 12 | Greece | 2000-2013 / 13 | 13 | 0 | 100 |

| 13 | Hungary | 1996-2013 / 17 | 14 | 3 | 82,24 |

| 14 | Iceland | 1995-2013 / 18 | 16 | 2 | 88,89 |

| 15 | Ireland | 1996-2012 / 16 | 16 | 0 | 100 |

| 16 | Italy | 1995-2013 / 18 | 18 | 0 | 100 |

| 17 | Japan | 1995-2013 / 18 | 16 | 2 | 88,89 |

| 18 | Latvia | 1995-2013 / 18 | 18 | 0 | 100 |

| 19 | Lithuania | 1996-2013 / 17 | 16 | 1 | 94,12 |

| 20 | Luxembourg | 1996-2012 / 16 | 13 | 3 | 81,25 |

| 21 | Macedonia | 1998-2010 / 12 | 10 | 2 | 83,33 |

| 22 | Malta | 2002-2013 / 11 | 10 | 1 | 90,91 |

| 23 | Netherlands | 1995-2012 / 17 | 16 | 1 | 94,12 |

| 24 | Norway | 1995-2013 / 18 | 15 | 3 | 83,33 |

| 25 | Poland | 1996-2013 / 17 | 17 | 0 | 100 |

| 26 | Portugal | 1996-2013 / 17 | 17 | 0 | 100 |

| 27 | Romania | 1995-2012 / 17 | 16 | 1 | 94,12 |

| 28 | Slovakia | 1995-2013 / 18 | 17 | 1 | 94,44 |

| 29 | Slovenia | 1995-2013 / 18 | 17 | 1 | 94,44 |

| 30 | Spain | 1995-2012 / 17 | 17 | 0 | 100 |

| 31 | Sweden | 1995-2013 / 18 | 15 | 3 | 83,33 |

| 32 | Switzerland | 1995-2013 / 18 | 18 | 0 | 100 |

| 33 | Turkey | 1995-2010 / 15 | 15 | 0 | 100 |

| 34 | United kingdom | 1995-2012 /17 | 16 | 1 | 94,12 |

| 35 | United states | 1995-2013 / 18 | 18 | 0 | 100 |

Table 2 – The Summary of the regularity verification for the analyzed economies

| Indicator | Value |

| Number of analyzed countries | 35 |

| Biggest research perid | 1995-2013 |

| Lowest research period |

2002-2013 |

| Biggest regularity satisfying, % |

100 |

|

Lowest regularity satisfying, % |

81,25 |

| Average percentage of regularity satisfying, % |

93,52 |

| Number of countries, for which the regularity is satisfying: |

|

| 80,1 – 85 % | 6 |

| 85,1 – 90 % | 6 |

| 90,1 – 95 % | 9 |

| 95,1 – 99,9 % | 0 |

| 100 % | 14 |

It is obvious from the tables that the regularity shows up in full 100 % for the 14 countries from the 35 considered; what’s more, for 9 countries the regularity is manifested in more than 90% of facts. The average value of the relevance of the economic processes for the regularity proposed is 93.52% (for the countries considered). It is important that the accuracy of the regularity is almost independent of the rate of the nation’s economic well-being.

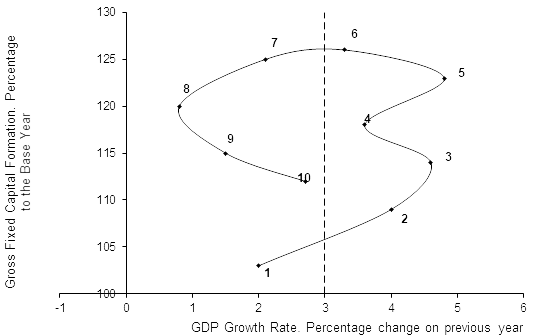

Fig. 3 shows the dependence of the GFCF and GDP growth rate for the US economy.

On this graph the data are presented in the chronological order, i.e., one point at the beginning of the curve corresponds to the starting year of the period analyzed, and the other at the end of the curve corresponds for the last year.

In accordance with the graph, the threshold value of GDP growth rate for the US economy is about 1.8%. From 1995 to 2000, from 2003 to 2006 and from 2010 to 2013, GDP growth rate values were in the above-threshold area; this corresponds to the growth of GFCF regardless of changes in GDP growth rate. During these periods, there was “the serpent” specific for the first section of the regularity. In 2001, the value of GDP growth rate was below the threshold level and was accompanied by a decline in GFCF (the second section of the regularity). In 2002 there was a decline of GFCF after a period of fall in GDP growth rate in the sub-threshold area (the fifth section of the regularity). In 2007-2009, there was a decrease of GFCF with GDP growth rate decrease, which corresponds to the second section of the regularity. In this case, the point 2007 was exactly on the threshold and behaved like a sub- threshold point. In 2010, GDP growth rate in the area of positive values of growth corresponds to the growth of GFCF (third section of the regularity). Thus, the revealed regularity was totally observed for the US economy in the considered time interval.

Conclusions

In the study, we have analyzed the economic processes taking place in 35 countries around the world. For these countries, the regularity of a country’s GDP growth rate affecting the volume of capital investment into their economy, previously discovered by the authors, has been verified. The results of verification are high. Thus, on average, in 93.52 % of cases of the economies of the countries analyzed the capital formation was held according to the regularity. In 14 of the 35 countries, investment processes came up to it.